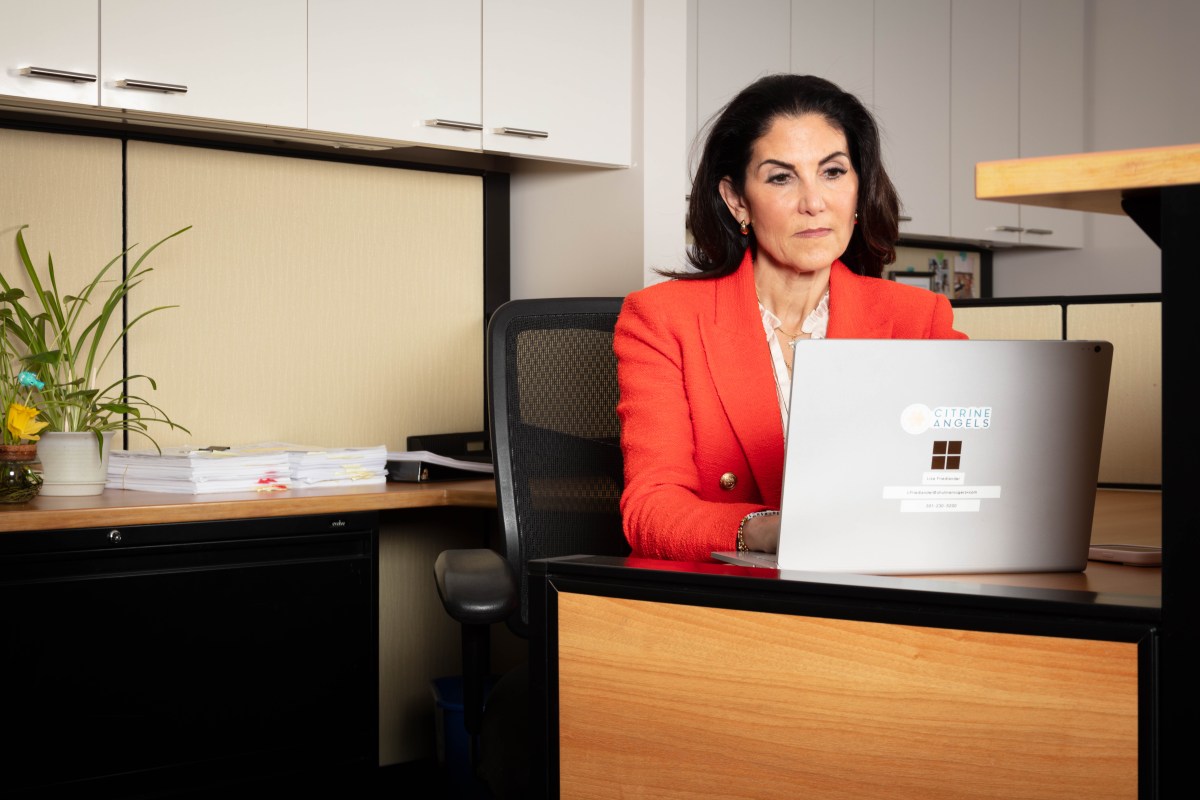

In February 2019, an article online caught the eye of Bethesda business executive and attorney Lisa Friedlander. It was about a new investor group called Citrine Angels, whose mission was to connect novice female investors with early-stage, women-led startups. Friedlander quickly emailed the founder, Allyson Redpath, to offer her support.

“For decades…the percentage of capital—venture capital—going to female founders has been 2% or under,” says Friedlander, who co-founded an online marketplace for summer camps and other activities for kids called Activity Rocket in 2013 and then sold the business four years later to Thrively, a California-based education technology platform. “When I launched and grew and sold my company…[I] experienced firsthand the discrimination and difficulties of female founders raising capital.”

Fast forward to today, and Friedlander is one of Citrine Angels’ principals. Named after the gemstone believed to promote prosperity, Citrine Angels has a dual purpose: It provides female-founded startups around the country with access to capital, and it teaches financially secure women throughout the D.C. area how to become successful angel investors.

“The idea is to create more women angel investors,” says Friedlander, who, along with two Northern Virginia women, took the helm in late 2019, after Redpath stepped aside to accept a high-ranking position with the Maryland Department of Commerce.

To be considered an accredited—or angel—investor by the U.S. Securities and Exchange Commission, an individual must have a net worth (spouses included) of more than $1 million, excluding their primary residence, or individual income of more than $200,000 for the past two years. Citrine Angels members also must meet these requirements.

A $995 annual fee gives them access to monthly virtual pitch presentations, as well as monthly in-person networking gatherings and educational opportunities that focus on everything from portfolio-building strategies to evaluating a startup for its investment potential. The group has a Bethesda mailing address, but its events are held either online or at sites around the D.C. area.

The nonprofit’s 80 members aren’t required to make regular investments, though they are encouraged to make at least a small investment every year—“as low as 5 and 10K,” Friedlander says.

The way it works: Citrine Angels accepts applications from female-led startups. A committee then vets each company, and those that pass the initial review are given the opportunity to pitch the group. If there’s enough interest in the startup from Citrine Angels’ members, then a lengthier due diligence process begins, with a deep dive into the startup’s financials, the marketplace for its product or services, and its leadership team. Once the due diligence report is shared with members, each decides whether she is interested in investing—either directly into the startup if the dollar amount she chooses to put up meets the startup’s minimum investment threshold, or by pooling funds and investing together. Upon investment, Citrine Angels adds the company to its portfolio.

As minority shareholders, Citrine Angels’ members typically see a return on their investment when the startup is acquired by another entity, generally within three to seven years, according to Friedlander.

“[We’re] looking closely at who the founders are…we have to really believe that these founders have what it takes to grow a company to be successful,” says Lisa Conners, a Bethesda-based

executive-leadership coach who became a member two years ago.

According to a 2018 Boston Consulting Group study, female-founded or co-founded businesses have an average rate of return of 78 cents for every dollar invested, compared to male-founded startups, which have an average rate of return of only 31 cents.

Since its inception in 2019, Citrine Angels has provided more than $1.25 million in capital to approximately 20 female-founded or co-founded companies across the country, in industries from consumer products to artificial intelligence to financial and medical technologies. Bethesda-based Pocket Naloxone Corp., which became part of Citrine Angels’ portfolio in 2020, is focused on developing an easy-to-use, lower cost, over-the-counter naloxone product to help in the battle to prevent deaths from opioid overdoses. It was Friedlander’s first personal investment as a Citrine Angel. “A huge game changer and an incredible opportunity to save lives,” Friedlander says about the startup.

Citrine Angels also provided capital to help Bethesda entrepreneur Julie Melnick expand SkySquad, the company she founded to provide airport travelers with personal assistants who can carry their bags, help ease their way through security and TSA lines, and navigate their way through the airport. The service is offered at five airports around the country, including Baltimore/Washington International Thurgood Marshall Airport.

When Melnick first pitched Citrine Angels for funding, the organization took a pass; Friedlander told her to “show us some traction” with customers first, Melnick says. She heeded the advice, and when she pitched the group again two years later, in 2021, her company came away with about $35,000 from Citrine Angels members, in a round of financing that netted approximately $1 million in all, she says.

“The whole experience of running a startup, I believe, is really mindset and believing that…your service or your product is really worth something,” Melnick says. With Citrine Angels, she adds, a whole group of women are investing their hard-earned money to support a business, and “it’s really a vote of confidence.”

This story appears in the May/June edition of Bethesda Magazine.